Financial Services companies are at risk of hefty fines due to ASIC RG 271 non-compliance.

Compliance, Risk, & Complaints leaders are underestimating RG 271 risks.

But the complex rules have already led to high-profile breaches and fines.

Leading Financial Services companies trust Complaints Pro

.png?width=1039&height=494&name=Moneyspot%20(1).png)

Is your organisation at risk of fines?

ASIC RG 271 poses real risks if complaints aren’t lodged correctly. Yet many Financial Services companies are falling short.

Compliance teams often assume full compliance. But RG 271’s complexity makes breaches very common, leading to audits and fines.

.jpg)

Recent high-profile RG 271 lawsuit: $11.1 million in fines

A high-profile company you've heard of (easy to Google!) recently faced court over ASIC RG 271 breaches, including:

- Failing to inform complainants of AFCA escalation rights

- Missing the 45-day response deadline

- Failing to explain delays

- Inadequate staffing for compliance

With $11.1 million in potential fines and lasting reputational damage, don’t risk the same pitfalls—ensure your organisation is RG 271 compliant.

Frontline teams failing to capture complaints data compliantly

Many frontline teams breach RG 271.179: “Firms must record all complaints they receive” by failing to log complaints resolved at first contact.

Why?

Complex processes, outdated tools, and a culture of avoiding minor complaint logging make compliance difficult. But under RG 271, even informal complaints—like phone resolutions—must be logged.

.jpg)

Your current system makes RG 271 compliance near-impossible

You may rely on a Complaints Management system like a spreadsheet or CRM patch - but most tools burden staff with cumbersome data entry.

As a result, only serious complaints get logged, putting your organisation at risk of breaches., Frontline staff need speed, not complex, jargon-filled forms. When systems aren’t user-friendly, complaints aren't logged correctly.

The board aren't aware of the level of risk

Compliance leaders we speak to often say:

“You’re right—we’re not RG 271 compliant and at risk of fines. I’ll take this to the board, but they probably won’t listen.”

Boards often fail to act, not understanding the entire risk. But if they’re aware and ignore non-compliance, they’re accountable.

.jpg)

Understand your RG 271 risk exposure with Causia’s free RG 271 Risk Assessment

Are you unsure whether your organisation fully complies with ASIC RG 271?

Causia offers a FREE, no-strings-attached 30-page RG 271 Risk Assessment for Australian Financial Services.

It highlights compliance gaps, educates your team on risks, and provides practical tips to prevent underreporting.

(It's free because we know a percentage of these assessments will result in enquiries about our Complaints Pro software)

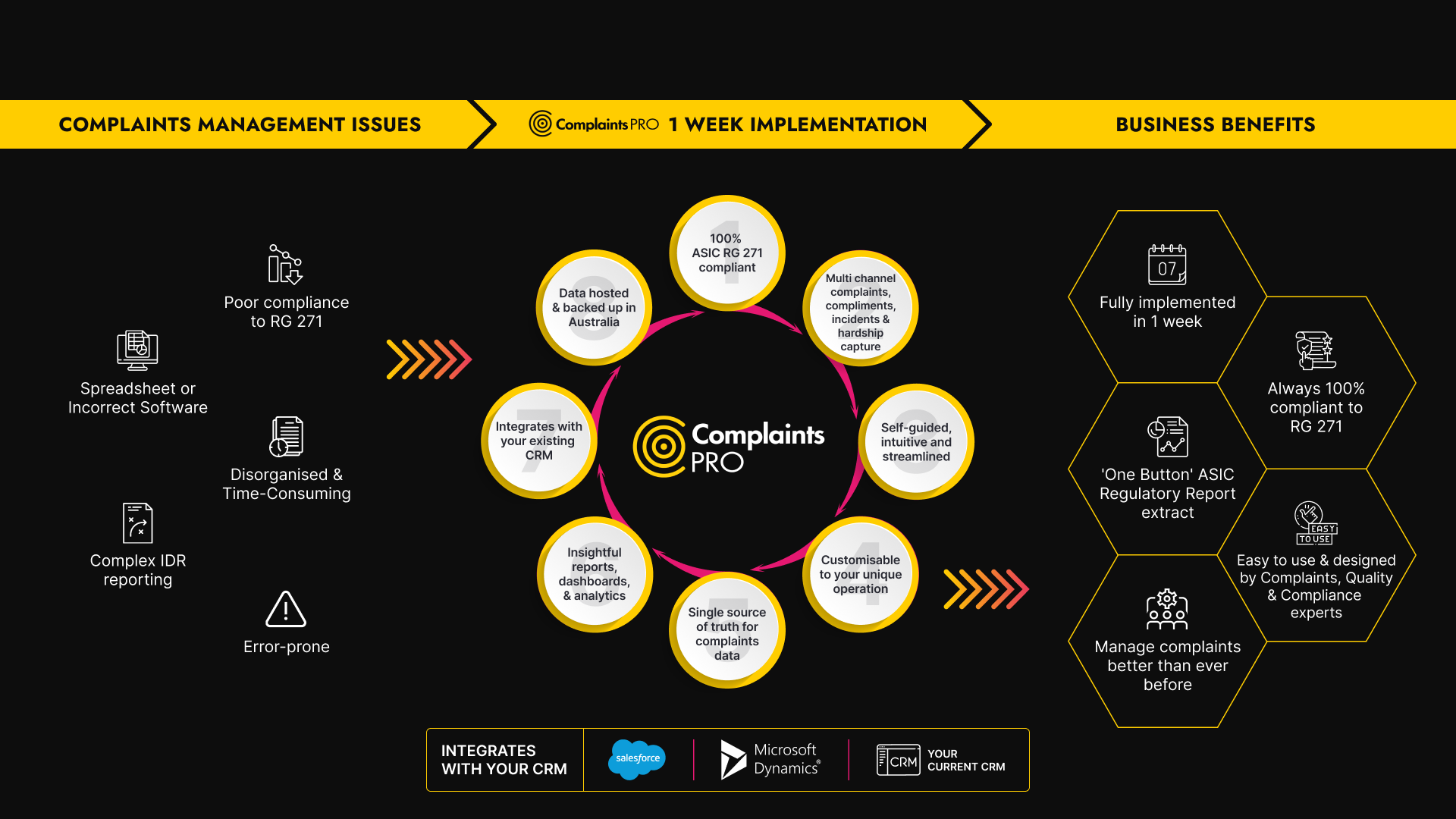

Introducing Complaints Pro: The best-in-class approach to RG 271 compliance

Looking for an RG 271 Compliant System?

If a system can't do this, then it isn't a RG 271 Compliant Complaints Management System.

| Requirement | Complaints Pro |

|---|---|

| 1-Week Implementation | ✅ |

| 1-Button ASIC IDR Regulatory Report Generator | ✅ |

| RG 271 Compliance out-of-the box | ✅ |

| RG 271 Non-compliance protection | ✅ |

| RG 271 Compliance Health Checker | ✅ |

| AI Powered Reporting & Analytics | ✅ |

| 6-Click Frontline Forms | ✅ |

| 1-Week Implementation | ✅ |

| Self-Guided & Intuitive Processes | ✅ |

| Full Training in 15 Minutes | ✅ |

| Multi-Channel Complaint Capture | ✅ |

| Streamlined Communication Management | ✅ |

Hear It Direct From Complaints Pro Customers ...

20

years

Experience in complaints management best-practice

Experience in complaints management best-practice

1

week

Software implementation time

#1

software

for Complaints Management in Financial Services

Book your free RG271 Risk Assessment

See how Complaints Pro is a cost-effective, ready-to-use solution via a free demo.

No more patchwork solutions that expose you to non-compliance and potential legal issues.

Why take the risk when Complaints Pro is a purpose-built system designed to handle everything?